KERRY BOULTON

Australia’s Most Respected Exit Strategy Advisor & CEO of The Exit Strategy Group

“Kerry is on a mission to educate business owners on how to create value in their businesses and prepare themselves for their next reinvention and phase of life.”

How to Exit Your Business Feeling Fulfilled, Personally Satisfied and With the Biggest Pay Day of Your Life!

Exit Strategy

With over 20 years in business as an entrepreneur, transformative coach, consultant, sought-after speaker and talented facilitator, Kerry wrote The Uncensored TRUTH About Exit Strategies to help as many business owners as she can to monetise the wealth that’s lying in their businesses.

The Uncensored TRUTH About Exit Strategies details how to build a strong and successful exit plan, which is an absolute must if you want to get full value from any sale. Kerry exposes and debunks many myths and gives you practical advice. She walks you through what most people don’t know – or refuse to believe – about the process of planning their exit.

Kerry believes exit planning is a process, not a destination. She helps you overcome challenges you’re likely to face as a business owner and most important, the steps to ensure you find financial freedom so that you don’t become just another statistic.

Value Builder

Kerry was coaxed out of her third “retirement” in 2013 and is now founder and CEO of The Exit Strategy Group. The Exit Strategy Group helps business owners and CEOs to maximise business value while systematically developing an exit plan.

When it comes to being able to ‘monetise’ a business for sale, Kerry Boulton has over $15.4 million worth of runs on the board from businesses she has successfully helped build and sell over the past three decades.

Over the past 20 years Kerry has mentored many owners through successful business growth -as well as many leaders in corporate Australia including…

– Ericsson Australia

– Telstra

– Ford Motor Company

– Domino’s Pizza

– Alternative Plastics Australia

– City of Melbourne

– Aussie Bodies

– CMTP Packaging Materials

– Qantas

– Queen Victoria Market

My Core Values

Help First

Do the Right Thing

If I cannot help you to achieve the outcome you want, I will do my best to refer you to someone who can.

Authenticity

With years of experience – both good and bad – you can rely on my integrity with confidence and trust.

Testimonials

10 Myths Every Business Owner Must Know Before Creating Their Exit Strategy

Are You Ready To Get Rich, Get Out And Get On With Enjoying Your Life?

About Kerry

As CEO and Founder of The Exit Strategy Group and NEXUS Business Coaching, I have helped numerous business owners build a strong and successful exit plan to monetise the wealth lying in their business. Over the past 20 years, I have mentored many owners through successful business growth – positioning them for their ultimate sale or for succession to family.

My mission is to educate business owners on how to create value in their businesses and prepare themselves for their next reinvention and phase of life – encompassing all that’s involved in business readiness, personal readiness and financial readiness.

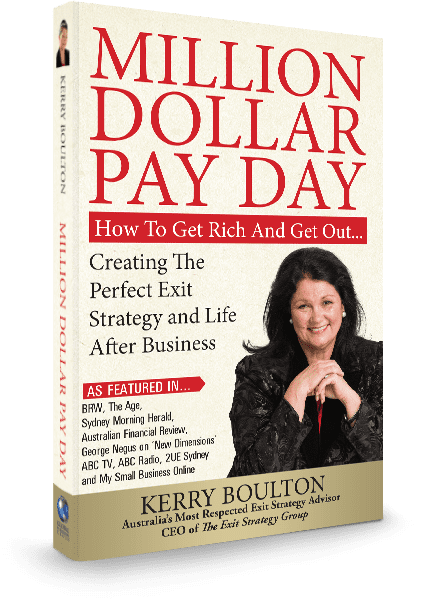

In my first book, “The Uncensored TRUTH About Exit Strategies”, I detail how to build a strong and successful exit plan, while exposing and debunking many myths believed by leading business owners like you.

Please read on to learn more about my passion and life’s work…

For more than 20 years Kerry has been a sought-after speaker and facilitator. She has given presentations and workshops relating to entrepreneurship, strategic thinking, management and business growth for many organisations, including…

– Melbourne Business School

– Macquarie Graduate School of Management

– Deakin University

– Swinburne University

– Monash University

– Australian Graduate School of Management

– The Leadership Consortium

– Committee for Melbourne

– The CEO Forum

– Institute of Chartered Accountants

– Australian Institute of Management

Despite leaving school at 15, Kerry achieved a Master’s Degree in Entrepreneurship and Innovation at the Australian Graduate School of Entrepreneurship in 1999. She was later invited to teach MBA students about Business Planning as an Adjunct Teaching Fellow at Swinburne University.

Kerry is a past member of the Advisory Board to the David Syme Business School at Monash University, also a member of the Advisory Board for the Australian Graduate School of Entrepreneurship at Swinburne University and served on the Advisory Committee for the Doctorate of Business Administration (DBA).

Kerry is very active in serving her community. She has been a director of 460degrees Expert Management Agency for 8 years – this agency develops and promotes new approaches to business & technology solutions. For 17 years now, Kerry has been on the committee for the South Melbourne District Sports Club which provides sports and athletic activities to people of all ages in her local community.

After serving on the judging panel for the Telstra Businesswomen’s Awards for six years, Kerry was nominated by her clients and became a finalist in 1999. She has appeared in the BRW, The Age, The Australian Financial Review, with George Negus on New Dimensions on ABC TV and with Elaine Canty on ABC Radio.